ブロックチェーン開発事業を手掛ける株式会社ナンバーワンソリューションズ(所在地:東京都目黒区、代表取締役:面来哲雄、以下当社)は、2021年度中にブロックチェーン技術を活用した資金調達のためのSTOプラットフォーム「tokenbase(以下トークンベース)」の運用開始を目指します。対象となるのは、海外の政府系金融機関や国内の不動産事業者です。

■新たな資金調達手法として注目されているSTOプラットフォーム

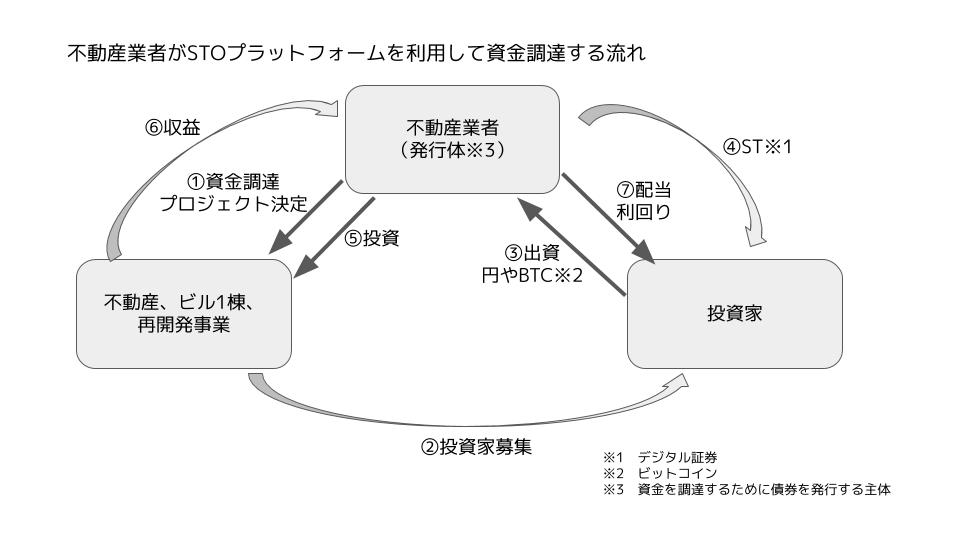

ブロックチェーンにより信頼を担保したデジタル証券を投資家に向けて販売することをSTO(セキュリティトークンオファリング)と呼びます。STOプラットフォームとは、デジタル化した証券(ST)に特化し資金調達ができるブロックチェーン上の取引所のことです。

STOは新たな資金調達の手法として、米国や日本をはじめ世界中から注目されています。STOが注目されている理由として、以下の4つが挙げられます。

・STOは大手企業だけではなく、中小企業やベンチャー企業でも扱うことが可能

・証券化できるものは、株式のほか、社債や不動産、事業開発、特許などの担保価値のあるもの

・資産を細分化して証券化することができる 例)ビル1棟を証券化するなど

・24時間365日いつでも取引が可能

STOを使った資金調達はこれまで日本国内で実現することが難しい状況でしたが、2020年5月から改正法※1が施行され、資金調達が可能になりました。投資家は法定通貨もしくは仮想通貨(暗号資産)を投資もしくは出資して、企業や事業の収益等から、収益分配などの配当を受けることができます。STOは従来の金融市場の規制に則った方法のため、安全性が担保※2されています。

※1 資金決済に関する法律及び金融商品取引法の改正法

※2 STOは各国の証券法に基づいた金融商品

■売れないものを売れるデジタル証券にすることが可能

当社が開発したSTOプラットフォームの「トークンベース」は、株式や社債、不動産、事業開発だけではなく、今まで証券化が難しかった資産にも対応することができます。

証券化が難しい資産とは次のようなものが挙げられます。実質の価値は高いが、流動性がない(売れない)資産です。

・ビル1棟

・鉱物資源および鉱山

・特許技術

・著作権

・サービス利用権など

「トークンベース」では社債、未上場株式、不動産、事業開発に加え、証券化が難しい資産をデジタル証券として発行することが可能です。流動性がないものを証券化することで新しい価値経済を実現することができます。

流動性の高い資金調達の手法を企業・投資家の双方が利用し、多様な投資商品の取引が可能となります。

■投資家の資産を安全に管理する3つの特徴

当社が開発したトークンベースは投資家の資産を安全に管理する以下の3つの特長があります。

・堅牢なコールドウォレット※1を搭載

・複数の秘密鍵が必要なマルチシグネチャ方式※2を採用

・独自の高セキュアな認証機能を搭載

※1 仮想通貨(暗号資産)を保管するウォレットのことで、必要な時以外はインターネット環境に接続しないセキュリティレベルの最も高いもの

※2 取引をする際、複数の秘密鍵を使うこと。ハッキングによる不正送金のリスクが減少する

■2021年度中の運用開始を目指す

当社は、ブロックチェーン技術を活用したSTOプラットフォーム「トークンベース」を2020年12月に開発しました。今後、海外の政府系金融機関や日本国内の不動産事業者へ提供し、2021年度中の運用開始を目指します。

【株式会社ナンバーワンソリューションズについて】

会社名 :株式会社ナンバーワンソリューションズ

本社所在地 :〒153-0043 東京都目黒区東山3-15-1出光池尻ビル7F

代表取締役 :面来哲雄(おもらい・てつお)

設立 :2002年7月

資本金 :5,000万円

連絡先 :TEL .03-6412-8470 FAX .03-6412-8471

URL :https://no1s.net

事業内容 :ブロックチェーン開発事業

【本件に関する報道機関からのお問い合わせ先】

株式会社ナンバーワンソリューションズ 広報担当:堂本健司

TEL 03-6412-8470 / Email press@no1s.net

プレスリリースはこちらよりダウンロードできます

ブロックチェーン技術を活用した資金調達システムのβ版を開発 2021年度中の運用開始を目指す